The Corporate Sustainability Reporting Directive

On 5 January 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force. It modernises and strengthens the rules concerning the social and environmental information that companies have to report. The new rules will ensure that investors and other stakeholders have access to the information they need to assess the impact of companies on people and the environment and for investors to assess financial risks and opportunities arising from climate change and other sustainability issues.

GRI

Arendals Fossekompani and our portfolio companies report on material impacts regarding a variety of ESG issues, such as climate change, health and safety, and corporate governance, inspired by the Global Reporting Initiative (GRI) recommendations.

GRI’s mission is to enable organisations to be transparent and take responsibility for their impacts, enabled through the world’s most widely used standards for sustainability reporting – the GRI Standards (www.globalreporting.org).

TCFD

First launched in 2015, the Task force on Climate-related Financial Disclosures (TCFD) recommendations has become best practice for how to manage and report on climate risks and opportunities (www.fsb-tcfd.org). The purpose of this standard is to give investors more knowledge on the financial impacts of climate-related issues, based on the four core recommendations: Governance, Strategy, Risk management, and Metrics and targets.

Over the course of 2020 and 2021, a climate risk analysis, including an assessment of different climate scenarios, was carried out for the AFK portfolio, based on TCFD recommendations.

SASB

The Sustainability Accounting Standards Board (SASB) provides a set of industry-specific standards that was used to guide the disclosure of financially material sustainability information for Arendals Fossekompani (www.sasb.org).

EU Taxonomy

The imminent threat of global warming calls for immediate action. According to a 2018 report by the Intergovernmental Panel on Climate Change (IPCC), limiting global warming to 1.5°C will require $3.5 trillion in annual investments. The European Union’s response to this urgent challenge is the European Green Deal (EGD), which offers a roadmap to guide the EU towards climate neutrality by 2050. Central to the EGD is the EU Taxonomy. The EU Taxonomy is a new, uniform classification system intended to guide investments towards sustainable activities, increase transparency and counteract greenwashing.

The EU Taxonomy addresses several aspects of environmental impact. Six overarching environmental objectives was established for the Taxonomy:

- Climate change mitigation

- Climate change adaption

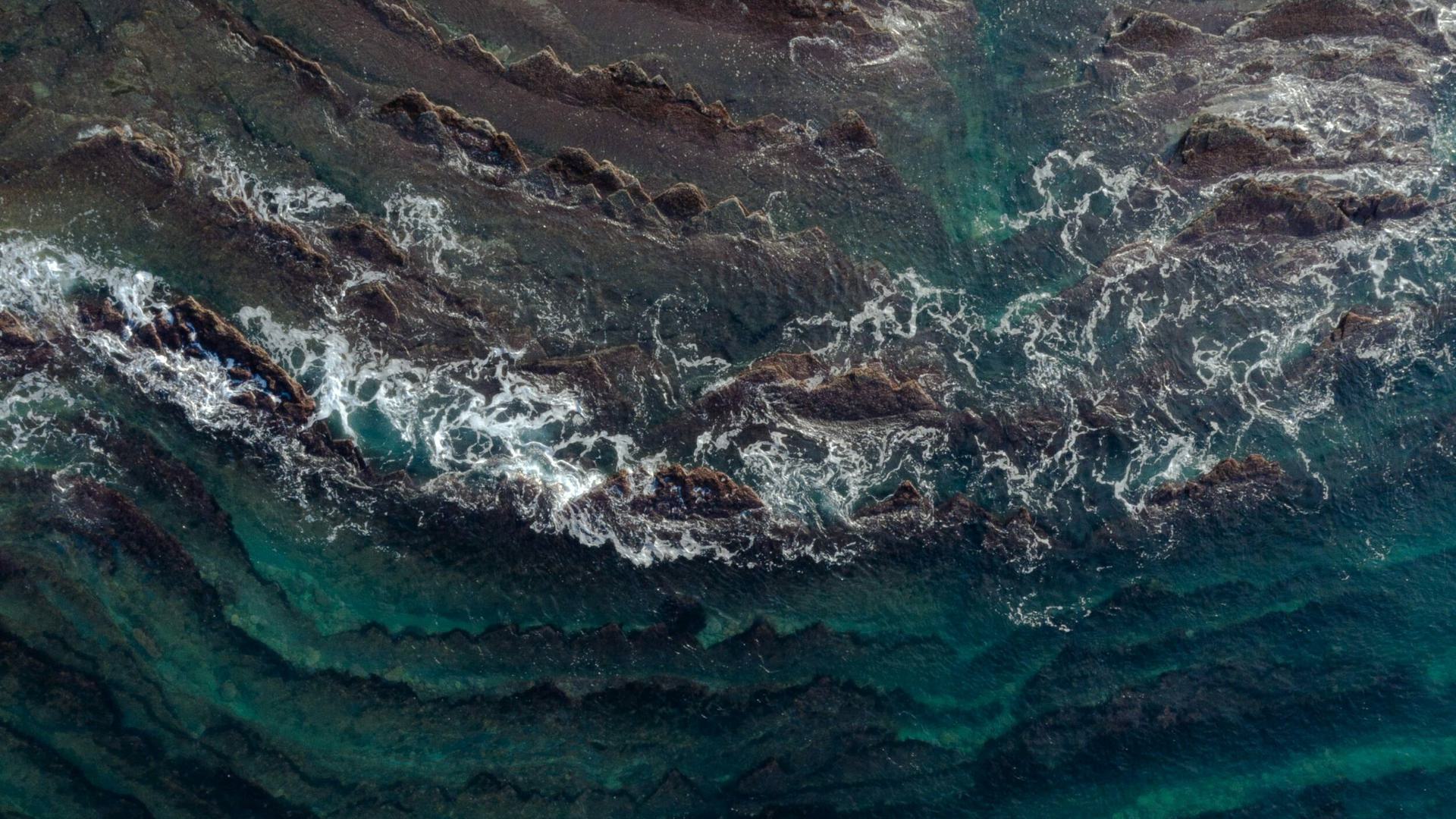

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems’

For an investment to be considered aligned with the EU Taxonomy, the following is required:

A. Substantial contribution to one of the six environmental objectives;

B. Doing no significant harm to the other five objectives, and;

C. Meeting the minimum social and governance safeguards (e.g. the OECD Guidelines on Multination Enterprises)

For an activity to be deemed Taxonomy-eligible, only the substantial contribution criteria need to be met.

The substantial contribution criteria, also known as the Technical Screening Criteria (TSC), are currently only established for two environmental objectives: climate change mitigation and climate change adaption. Complete TSC for all six objectives will be presented in 2022.