Our commitments

It is crucial to our investments’ long-term success is a solid ESG framework, ensuring proper governance and compliance, a prosperous work environment and a focus on contributing to the energy transition.

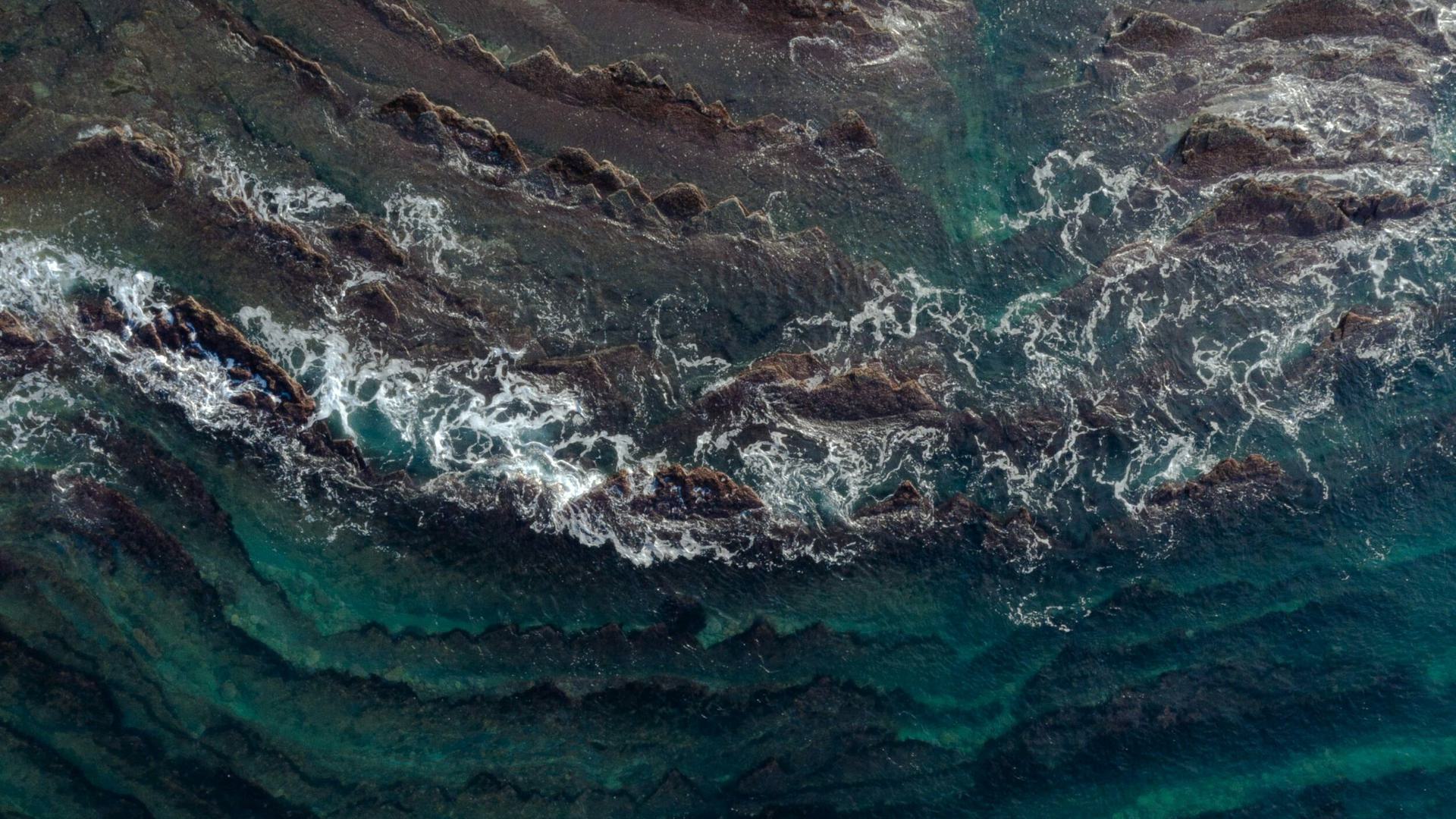

Material Topic: Biodiverstiy

In Arendals Fossekompani, we are committed to environmental sustainability in all our business decisions and operations. We recognise the impact companies have on the environment and consider environmentally sustainable business conduct as both an opportunity to ensure long-term performance and growth, and a necessity to reach the objectives set out in the Paris Agreement. We have developed the Environmental Policy for the purpose of promoting and maintaining a focus on high environmental standards throughout all business operations.

Arendals Fossekompani will adopt the Kunming-Montreal Global Biodiversity Framework for biodiversity in the same manner as the Paris Agreement for climate.

Material Topic: Economic Performance

Our actual and potential impact relating to economic performance is mainly positive: As an owner and a parent company we engage directly in the sustainability performance of our portfolio companies, and through individual materiality assessments and climate risk analysis, we focus on material topics that will increase our economic performance and reduce the risks in the portfolio. We recognise the impact companies have on the environment and consider environmentally sustainable business conduct as an opportunity to ensure long-term performance and growth.

Material Topic: Strengthening sustainability performance

Continuously strengthening the sustainability performance is essential for optimising our portfolio of green-tech companies. Arendals Fossekompani seeks to achieve long-term value through our investments. Crucial to our long-term success is a solid sustainability framework, ensuring proper governance and compliance, a great working environment, and a focus on our contribution to the green transition. All our investments are subject to a sustainability onboarding processes, which include an initial materiality assessment and the identification of sustainability focus areas for the company. Once onboarded, our portfolio companies are integrated in the annual sustainability assessments and reporting processes. To be aware of risks and opportunities, we conduct climate risk assessments of all our companies annually. Each year, we also screen eligibility and alignment with the EU Taxonomy Regulations for all companies. . In order to strengthen the sustainability performance of our portfolio companies, we also monitor GHG emissions for Scope 1 and Scope 2 , in addition to a limited Scope 3 reporting

How we work to integrate ESG

All investments are subject to an ESG onboarding process, which includes an initial materiality assessment and the identification of ESG focus areas for the company. Our companies are then integrated in our annual ESG assessment and reporting processes. We conduct climate risk assessment of all companies annually, and we will be screening our portfolio companies eligibility and alignment with the EU taxonomy each year moving forward.

- Acquisition of company

- ESG onboarding

- Identify material ESG topics and focus areas for the business

- Annual assessments and reporting processes

- Higher valuation through increased awareness and transparency on ESG issues

Ambitions and goals for 2024

We are an industrial investment company, supporting the energy transition. Together with our portfolio companies, we will provide green, enabling technologies to accelerate global efforts to meet the goals of the Paris Agreement.

Reducing absolute Scope 1 and Scope 2 GHG emissions by 42% by 2030.

Reducing absolute Scope 1 and Scope 2 GHG emissions by 42% by 2030.

Follow up on our commitment to the Science Based Targets Initiative.

EU taxonomy eligibility and alignment

EU taxonomy eligibility and alignment

Conduct an assessment of the portfolio’s alignment with the EU Taxonomy. Re-evaluate our eligibility.

Report according to the AFK Green Bond Framework

Report according to the AFK Green Bond Framework

AFK’s Green Bond Framework is aligned with the Green Bond Principles published by the International Capital Market Association (ICMA).

Update climate risk and materiality analyses

Update climate risk and materiality analyses